Did you know that 29.3% of businesses in 2024 are using AI to optimize their budgets? The introduction of automated budget planning and forecasting tools has revolutionized financial management for CFOs and CMOs working in the retail sector.

These tools provide real-time insights into financial health, enabling proactive adjustments to spending and investment strategies. Thus effective budget management is not just a financial necessity; it’s a strategic advantage in the highly competitive industry.

However, budget planning in retail is a complex topic that requires the use of different tools for various aspects of the business. Each function such as marketing, inventory, and operations has unique data sets, performance indicators, and forecasting models. Using specialized tools ensures that each function is optimized for specific requirements, leading to more accurate and actionable insights.

For the sake of this guide, we will focus on marketing budget planning and forecasting.

The importance of marketing budget plan

Strategic allocation of marketing resources

Effective marketing budget planning is crucial for the strategic allocation of resources in retail. It allows businesses to prioritize spending based on their marketing goals and operational needs, ensuring that funds are directed towards activities that drive growth and profitability.

By setting clear financial targets and distributing marketing resources accordingly, retailers can optimize their digital advertising, social media campaigns, email marketing, and influencer partnerships, leading to more efficient and effective marketing operations.

Predicting marketing ROI

Marketing budget planning helps predict the ROI of different marketing activities, providing a clear picture of the business’s financial health. With accurate ROI predictions, retailers can avoid ineffective marketing spend, plan for seasonal fluctuations, and ensure they have sufficient funds to cover marketing expenses, invest in growth opportunities, and manage unforeseen financial challenges.

Risk management in marketing

Retail businesses face various financial risks from market volatility to unexpected expenses. Marketing budget planning acts as a risk management tool by identifying potential financial pitfalls and enabling proactive measures to mitigate them.

Retailers can forecast potential risks and develop contingency plans by analyzing historical data and market trends. This preparedness helps reduce the impact of financial shocks and maintain business stability.

Measuring marketing performance

A well-structured marketing budget serves as a benchmark for measuring a retail business’s performance. By comparing actual marketing results against budgeted figures, retailers can assess how well they meet their financial goals. This comparison highlights overperformance and underperformance, providing insights into operational efficiencies and inefficiencies.

Enhancing marketing decision-making

Marketing budget planning and forecasting equip retailers with data-driven insights that enhance decision-making. With a clear understanding of their financial position and future projections, retailers can make informed choices about expanding product lines, entering new markets, or investing in new marketing technologies.

Steps to create a marketing budget plan

Now let’s dive into seven essential steps to develop a thorough and effective budget plan

Step 1: Set clear goals

Begin by defining specific, measurable, achievable, relevant, and time-bound (SMART) goals for your budget. Align these with overall business goals such as increasing market share, launching new products, or entering new markets. Clear objectives provide direction and focus for your budgeting efforts.

Step 2: Gather data

Data is the foundation of an accurate and effective budget. Start by collecting historical sales data, market research, and industry benchmarks. This process involves analyzing past performance across all sales channels to identify trends, seasonal variations, and patterns.

You are also required to gather data on customer preferences, competitor strategies, and economic indicators that impact your sales. This comprehensive data collection will provide insights into making informed budget decisions.

Step 3: Forecast KPIs accurately

KPI forecasting is the cornerstone of a multichannel budget plan. It involves predicting future sales across various channels based on historical data, market trends, and consumer behavior.

Building short-term forecasts using MMM:

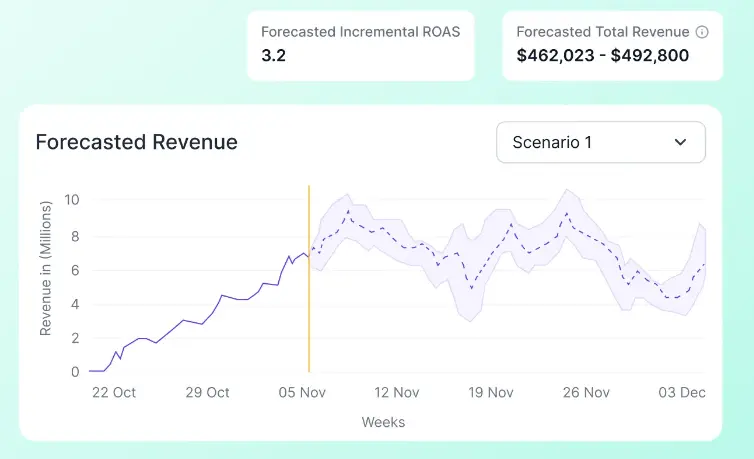

A well-designed MMM provides estimates of the causal relationships between marketing variables and business KPIs, such as revenue. These causal estimates enable forward-looking forecasts based on varying marketing mixes.

Short-term forecasting relies on the insights provided by MMM. This involves decomposing KPI time series data into seasonality and trends, identifying the contributions of paid and non-paid components, and understanding the adstock and saturation effects of paid media variables.

For accurate short-term forecasts, non-paid components (such as organic, contextual, and baseline factors) are projected using time series extrapolation. Paid components are forecasted by using media variables as predictors, taking into account adstock and saturation effects to ensure the forecasts remain realistic.

forecasted-revenue-using-mmm

Challenges of long-term forecasting

Long-term forecasting is more complex due to shifts in saturation curves and platform positions. Unlike short-term forecasts, which can rely heavily on MMM, long-term predictions require iterative model adjustments.

How do we validate MMM forecasts?

For Marketing Mix Modeling (MMM) forecasts to be effective, the entire organization must trust them. Building this trust involves a process called backtesting.

Backtesting tests how the model’s predictions would have performed historically by retraining the model up to specific points in time and then forecasting unseen data.

This allows companies to assess the model’s accuracy and ensure its predictive power is robust. Also, backtesting should be an integral part of the initial model build to establish reliability and confidence in the MMM forecasts.

Step 4: Plan scenarios & allocate marketing budgets

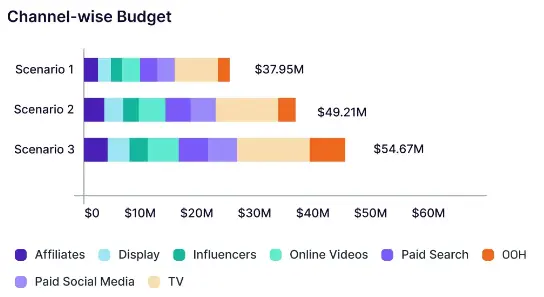

A comprehensive marketing budget is essential for promoting products across different channels. This includes allocating funds for digital advertising, social media campaigns, email marketing, in-store promotions, and influencer partnerships.

budget-channel-wise-allocation

Budget optimization tools powered by MMM can effectively optimize your future ad spending. By analyzing historical data, these models predict the ideal budget distribution to achieve maximum results. After that, it automatically adjusts your budgets for the upcoming week, ensuring optimal allocation and performance.

Generally, these tools have an added feature like scenario planning that allows you to change your budget and reallocate it for each channel based on the new analysis. Then, the budget is automatically distributed across channels according to the best model, and you can see the original vs. optimized ad spend distribution. You can use Lifesight’s UMM tool here.

Best practices for marketing budget planning & forecasting

1) Use scenario planning tools

According to a McKinsey study, companies that engage in detailed scenario planning are 20% more likely to outperform industry benchmarks. Ideally, marketers should have access to interactive tools that allow them to upload budgets, explore scenarios, and view forecasts without needing a data scientist.

2) Sliding period approach for iterative forecasting

The sliding period approach involves creating a Marketing Mix Modeling (MMM) model to forecast the next three months. This model is then updated with planned spending and predicted returns. Moreover, the refreshed model is used for the following quarters.

This iterative process accounts for adstock effects and ensures that forecasts remain accurate over extended periods, addressing inherent challenges effectively.

3) Aligning MMM forecasts with finance

Marketers can enhance collaboration by sharing MMM forecast outputs with finance and other stakeholders, ensuring realistic budgets and targets. The typical workflow involves:

- Initial alignment: The finance and marketing teams agree on high-level goals and a rough budget based on last year’s media spend.

- Running the budget: Marketing runs the budget through the MMM, refining it to align with realistic channel expectations and goals.

- Review and iterate: The revised budget and revenue targets are shared with finance for further adjustments.

Final thoughts

A data-driven budget plan is crucial for navigating the complexities of the retail landscape. It drives strategic decision-making, optimizes resource allocation, and supports sustainable growth. By adopting best practices and leveraging advanced analytics, retailers can achieve financial stability and competitive advantage.

Ready to optimize your budget planning and forecasting? Book a demo with Lifesight today to see how our solutions can elevate your retail measurement strategy.

You may also like

Essential resources for your success