In the dynamic world of digital marketing, understanding the true cost of acquiring customers is crucial for optimizing campaigns and maximizing return on investment (ROI). Cost Per Acquisition (CPA) is a key metric that helps marketers gauge the efficiency of their advertising efforts. This guide will walk you through everything you need to know about CPA, from basic calculations to advanced strategies for leveraging this metric in your digital marketing campaigns.

What is Cost Per Acquisition (CPA)?

Before we dive into the calculations, let’s define what we mean by Cost Per Acquisition:

Cost Per Acquisition (CPA) is a marketing metric that measures the total cost associated with acquiring a new customer or generating a conversion. It takes into account all the marketing and advertising costs involved in converting a potential customer into an actual customer.

For digital marketers, understanding CPA is crucial because:

- It helps assess the profitability of marketing campaigns

- It guides budget allocation across different channels and campaigns

- It’s a key metric for optimizing advertising spend

- It allows for comparison of different marketing strategies

- It’s often used as a bidding strategy in digital advertising platforms

The Basic Formula for Calculating CPA

The basic formula for calculating CPA is straightforward:

CPA = Total Cost of Campaign / Number of Acquisitions (or Conversions)

Here’s what each component means:

- Total Cost of Campaign: This includes all expenses related to the marketing effort, such as ad spend, content creation costs, agency fees, etc.

- Number of Acquisitions: This is the total number of new customers acquired or conversions generated as a result of the campaign.

Step-by-Step Guide to Calculating CPA

Let’s break down the process of calculating CPA with a practical example:

Step 1: Define Your Conversion Action

First, determine what counts as an “acquisition” or “conversion” for your campaign. This could be:

- A product purchase

- A newsletter sign-up

- A form submission

- An app download

For this example, let’s say we’re measuring product purchases.

Step 2: Gather Your Campaign Cost Data

Collect all costs associated with your marketing campaign. This might include:

- Ad spend across different platforms (Google Ads, Facebook Ads, etc.)

- Content creation costs

- Landing page development costs

- Agency or freelancer fees

Let’s say your total campaign costs for a month were $10,000.

Step 3: Track Your Conversions

Use your analytics tools to track the number of conversions (in our case, product purchases) generated by the campaign.

For this example, let’s say your campaign resulted in 200 product purchases.

Step 4: Apply the CPA Formula

Now, let’s plug these numbers into our formula:

CPA = $10,000 / 200 = $50

This means that, on average, it cost your company $50 to acquire each new customer through this campaign.

Interpreting CPA in Marketing Contexts

Now that we’ve calculated CPA, what does this mean for your digital marketing strategies?

- Profitability Assessment: Compare your CPA to the average customer lifetime value (CLV) to ensure profitability.

- Campaign Comparison: Use CPA to compare the efficiency of different marketing campaigns or channels.

- Budget Optimization: Allocate more budget to campaigns with lower CPAs, if they can maintain volume.

- Bidding Strategy: In platforms like Google Ads, you can use target CPA as a bidding strategy.

- Performance Benchmarking: Compare your CPA to industry benchmarks to assess your competitive position.

Real-World Applications in Digital Marketing

Let’s explore some specific scenarios where calculating CPA can inform your marketing decisions:

1. Comparing Channel Performance

Scenario: You’re running campaigns on both Google Ads and Facebook Ads and want to compare their efficiency.

Google Ads:

- Total Cost: $5,000

- Conversions: 80

- CPA = $5,000 / 80 = $62.50

Facebook Ads:

- Total Cost: $3,000

- Conversions: 60

- CPA = $3,000 / 60 = $50

In this case, Facebook Ads has a lower CPA, suggesting it might be more cost-effective. However, you’d also need to consider factors like conversion volume and quality.

2. Assessing Campaign Profitability

Scenario: You’re selling a product with a profit margin of $40 per unit.

Campaign A:

- CPA: $35

- Profit per acquisition = $40 – $35 = $5

Campaign B:

- CPA: $45

- Profit per acquisition = $40 – $45 = -$5

Campaign A is profitable, while Campaign B is losing money on each acquisition. This insight could guide budget reallocation or campaign optimization efforts.

3. Optimizing for Different Conversion Types

Scenario: You’re tracking both newsletter sign-ups and product purchases.

Newsletter Sign-ups:

- Total Cost: $1,000

- Conversions: 500

- CPA = $1,000 / 500 = $2

Product Purchases:

- Total Cost: $5,000

- Conversions: 50

- CPA = $5,000 / 50 = $100

While newsletter sign-ups have a much lower CPA, you’d need to consider the relative value of each conversion type to your business.

Advanced Considerations in CPA Calculations

As you become more proficient with basic CPA calculations, consider these advanced concepts:

1. Blended CPA

When running multiple campaigns or using multiple channels, calculate a blended CPA:

Blended CPA = Total Cost Across All Campaigns / Total Conversions Across All Campaigns

2. Assisted Conversions

Some marketing touchpoints may assist in conversions without being the last click. Consider using an attribution model that accounts for these assists:

Adjusted CPA = Total Cost / (Direct Conversions + (Assisted Conversions * Attribution Weight))

3. Customer Lifetime Value (CLV) to CPA Ratio

To ensure long-term profitability, compare your CPA to the expected CLV:

CLV:CPA Ratio = Customer Lifetime Value / Cost Per Acquisition

A higher ratio indicates better long-term value from your acquisitions.

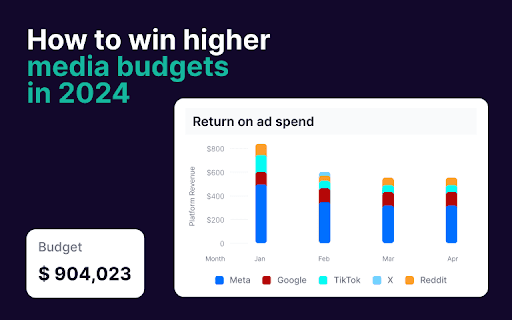

4. Return on Ad Spend (ROAS)

ROAS is the inverse of CPA when dealing with purchase value:

ROAS = Total Revenue from Ad Campaign / Total Cost of Ad Campaign

5. Marginal CPA

As you scale campaigns, consider the marginal CPA – the cost of acquiring the next customer:

Marginal CPA = Change in Total Cost / Change in Number of Acquisitions

Common Pitfalls to Avoid

When working with CPA in digital marketing, watch out for these common mistakes:

- Ignoring Quality of Acquisitions: A low CPA isn’t always better if it results in low-quality customers or leads.

- Overlooking Lifetime Value: Don’t pursue a low CPA at the expense of acquiring high-value, long-term customers.

- Neglecting Brand Impact: Some high-CPA campaigns might have significant brand-building effects not captured in immediate conversions.

- Focusing Only on Last-Click: Consider the full customer journey and use appropriate attribution models.

- Ignoring Seasonality: CPA can vary significantly based on seasonal factors; ensure you’re making fair comparisons.

Tools for CPA Analysis

Several tools can assist you in calculating and analyzing CPA:

- Google Analytics: Provides conversion tracking and CPA calculations when linked with Google Ads.

- Facebook Ads Manager: Offers detailed CPA metrics for Facebook and Instagram campaigns.

- CRM Systems: Platforms like Salesforce or HubSpot can help track the full customer journey and associated costs.

- Marketing Attribution Tools: Solutions like Attribution or Rockerbox can provide multi-touch attribution models for more accurate CPA calculations.

- Custom Dashboards: Many agencies develop proprietary tools to track and analyze CPA across channels and campaigns.

Leveraging CPA in Your Marketing Strategy

Understanding and effectively using CPA calculations can significantly enhance your digital marketing efforts. Here’s how you can leverage this metric:

- Budget Allocation: Distribute budget towards channels and campaigns with lower CPAs, assuming they can maintain volume and quality.

- Bidding Strategies: Use target CPA bidding in platforms like Google Ads to automate bid adjustments.

- Campaign Optimization: Continuously test and refine your campaigns to lower CPA while maintaining conversion quality.

- Funnel Analysis: Use CPA at different stages of your marketing funnel to identify optimization opportunities.

- Competitive Analysis: Benchmark your CPA against competitors to gauge your market position and identify areas for improvement.

- Pricing Strategy: Use CPA insights to inform your pricing strategy, ensuring profitability on each acquisition.

- ROI Forecasting: Use historical CPA data to forecast the potential returns on increased marketing investment.

Conclusion: Making CPA Work for Your Digital Marketing

Cost Per Acquisition is more than just a metric—it’s a powerful tool that can drive your entire digital marketing strategy. By mastering the calculation and interpretation of CPA, you equip yourself to make data-driven decisions that optimize your marketing spend and drive business growth.

Remember, while CPA is crucial, it should be balanced with other key performance indicators. The most successful digital marketing strategies consider CPA alongside metrics like customer lifetime value, brand equity, and overall market share.

As you continue to refine your approach to measuring and optimizing CPA, you’ll develop a more nuanced understanding of the true cost and value of your customer acquisitions. This knowledge will empower you to create more efficient marketing campaigns, allocate your budget more effectively, and ultimately drive better results for your business.

So, the next time you’re planning a digital marketing campaign, assessing channel performance, or making a case for marketing budget, remember to dive deep into your CPA data. It might just be the key to unlocking unprecedented growth and efficiency in your digital marketing efforts!

Free essential resources for success

Discover more from Lifesight