What is CPA Fraud?

Cost Per Action (CPA) Fraud, also known as Cost Per Acquisition Fraud, is deceptive activity aimed at generating false results to make an advertising campaign appear more successful than it actually is. This type of fraud typically occurs in digital advertising, specifically within affiliate marketing, where advertisers pay affiliates based on specific actions (e.g., clicks, sales, or form submissions) rather than impressions or views.

Fraudsters manipulate these actions falsely to earn more revenue. They employ a multitude of tactics like cookie stuffing, click injection, fake installations, and even using bot traffic to inflate CPA metrics, leading to deceptive results.

Formula

CPA is calculated as: Total Cost of Campaign/Number of Actions.

In the context of CPA fraud, actions are inflated artificially, thereby reducing the cost per action, presenting a misleading image of campaign success.

Example

Consider a scenario where an advertiser pays an affiliate for every software installation. The affiliate uses fake devices or automated bots to install the software, inflating the number of installations. The advertiser ends up paying for these fraudulent installations, thereby experiencing CPA fraud.

Why is CPA Fraud important?

Understanding CPA fraud is instrumental in maintaining the integrity of your ecommerce business. Falling victim to CPA fraud can lead to wasted ad spend, distorted analytics, and impaired decision-making. It devalues your return on investment (ROI) and can deflate trust in digital marketing efforts.

Which factors impact CPA Fraud?

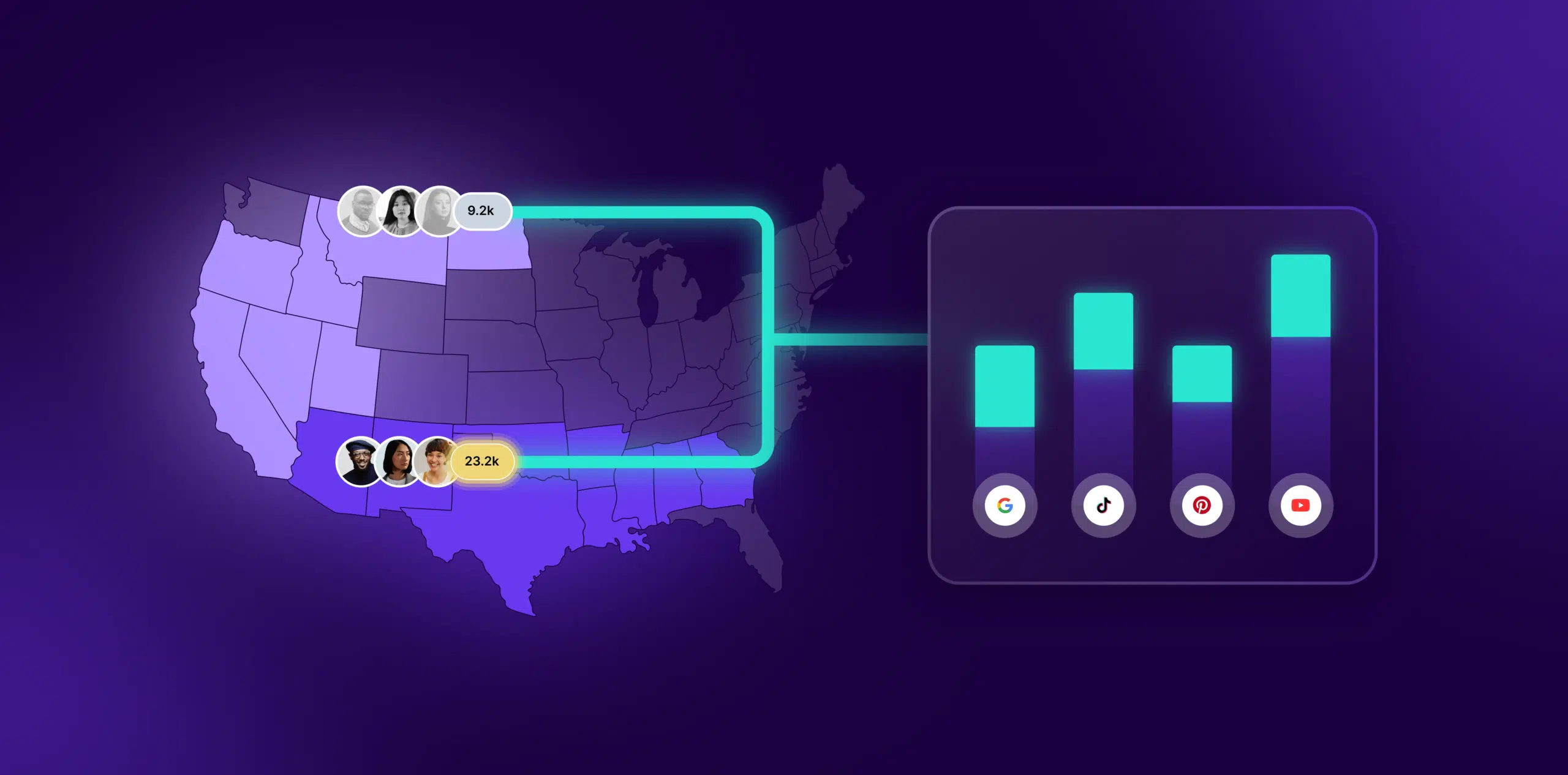

Effective mitigation of CPA fraud involves careful selection of affiliates, robust tracking mechanisms, and advanced fraud detection tools. Regular campaign audits and partnering with credible affiliate networks can significantly reduce the risk. Furthermore, adopting machine-learning algorithms can help detect anomalous patterns indicative of fraud.

How can CPA Fraud be improved?

CPA fraud is heavily influenced by the quality of your affiliate network, the efficacy of your tracking systems and the sophistication of fraud prevention measures in place. A lax oversight or weak detection mechanisms can escalate susceptibility to fraud.

What is CPA Fraud’s relationship with other metrics?

CPA fraud directly impacts important ecommerce metrics such as ROI, Cost Per Click (CPC), Customer Acquisition Cost (CAC), and Lifetime Value (LTV). By inflating the number of actions, CPA fraud artificially decreases the CPA, presenting an inflated ROI, deflated CPC and CAC, and potentially skewing LTV calculations. This misleading data impedes informed business decisions.

Free essential resources for success

Discover more from Lifesight