Have you noticed how countless discount notifications from ecommerce stores have started pouring in since the beginning of October?

It marks the beginning of a three-month-long festival season, starting with Halloween and followed by Thanksgiving, Christmas, Black Friday, and New Year. Customers around the world are willing to spend more during this time, and ecommerce stores capitalize on this opportunity.

While stores record new sales milestones through such seasonal campaigns, it becomes challenging for marketers to analyze the impact of these campaigns on overall ROI. To understand the effectiveness of your marketing strategies, you need to separate the sales driven by seasonal demand from those by increased marketing activities.

That’s where seasonal marketing mix modeling (MMM) allows the modern marketer to dissect and understand the relationship between seasonal trends, marketing efforts, and sales.

Here, dive deeper into the challenges of seasonality analysis in marketing and how seasonal MMM can address them.

Top Challenges Faced by Marketers in Seasonality Analysis

Seasonality must be distinguished from other influential factors and this process can be fairly straightforward or extremely complex.

Some of the significant challenges associated with seasonality analysis are:

Multiple seasonalities

Let’s take the month of December as an example. You can observe multiple seasonal peaks in your sales trend during this month due to pre-Christmas, Christmas, and post-Christmas/New Year shopping drives.

It is a complex process to break down the effects of all these seasonalities on the overall sales.

Sparse data

When data is not evenly distributed over time, such as infrequently sampled data or a few data points, seasonality estimation is impacted. On the contrary, seasonal campaigns fluctuate a lot, and each year, businesses get exposed to new data points. The involvement of new data sources increases the possibility of generating more scattered data, making it a complex data collection process.

For better quality seasonality estimation, it is recommended to have at least two years of daily or weekly data handy.

Data irregularities

Seasonality analysis is distorted by outliers in the data generated due to external factors such as natural disasters, recession, pandemics, political inconveniences, and so on.

Suppose a cyclone damages life and property during the festive season in November, it would lead to a pause in shopping as people would restrict spending while overcoming their losses. It is standard practice to detect and remove outliers during data screening.

Seasonality vs. Trends – Do’s and Don’ts

Businesses rely on time series forecasting, which is a proven statistical model to predict future data based on historical data analysis. It helps marketers identify the data patterns from previous campaigns and extract useful information like top-performing months, spikes and dips, and other changes during holiday seasons.

It is important to know what seasonality analysis can tell you and where you are likely to misinterpret the trends. Seasonality doesn’t always have a timed impact on overall sales. For example, Christmas shopping can start in November and continue until post-Christmas.

How can you quantify the impact of seasonal trends on your overall sales?

A simple way to approach this is to identify the popular products during this festival period so that retailers can perform logistic planning and restock these items to avoid stockouts. For instance, an e-retailer can restock chocolates and flowers before Valentine’s Day if time series analysis shows that these were the most sold items in the last two consecutive years during this special day.

The output of time series analysis also depends on historical trends. For example, a fantasy collection store may observe a peak in sales volume of costumes, candies, and pumpkins during the 4th of July holiday. However, it is difficult to determine whether this is a regular business trend that depicts early Halloween shopping or a seasonal peak.

The only way to find an answer is by adjusting your seasonal data and removing general trends and peaks from your data sequence. Once the regular peaks are removed, you can proceed with the specific datasets associated with seasonal factors.

If you use unanalyzed data that combines both seasonal and trends, the possibility of misinterpreting the outcomes increases, resulting in inaccurate marketing decisions.

Suppose you sell an electronic product, and overall sales have declined between August and October. This makes you think that your product might have some faults, and accordingly, you decide to invest in testing its functionalities. However, at the beginning of November, you notice a sudden peak in sales, so you don’t test the product. Instead, you decide to spend more on advertising to increase the sales order volume further. This leads to a large number of unsold and returned items.

In reality, the increase in sales might be the result of seasonality. Ideally, you should have assessed your product functionalities and reduced your advertisement spending.

Role of Marketing Mix Modeling in Seasonality Analysis

Data and timing are the two biggest factors that affect seasonal marketing campaigns. An accurately trained marketing mix model is foundational in executing seasonal analysis.

Capitalize on data

It is common to face data challenges in marketing mix modeling. Nevertheless, access to authentic data helps you correctly train your marketing mix model to get the desired outcomes. You can start by modeling your historical sales and conversion data using a mixed model to identify seasonal impacts. These inputs help predict the role of seasonality in your overall ROI.

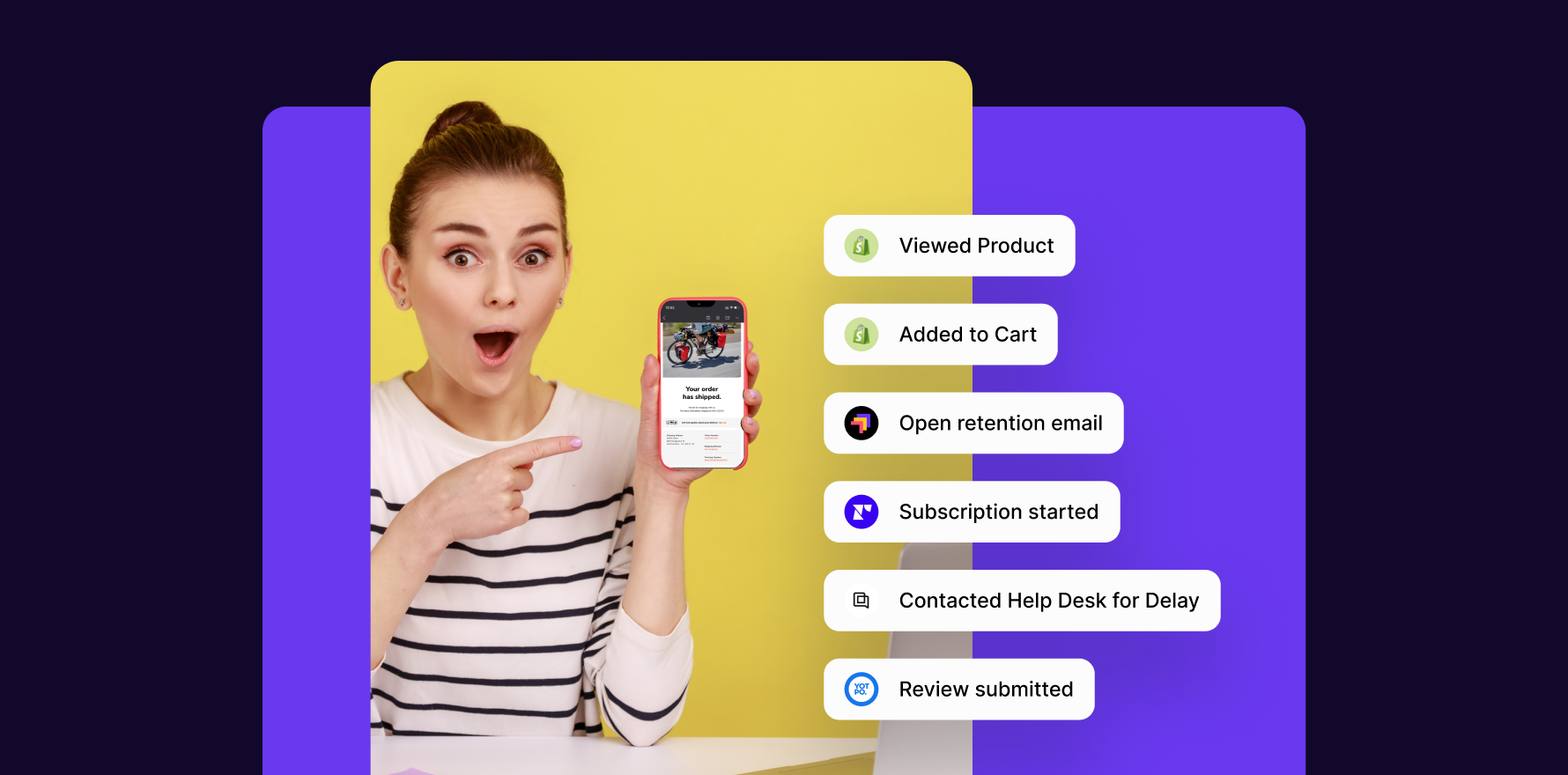

Consider training your marketing mix models with customer data. By feeding your model with datasets like demographics and locations of customers, you’ll unlock insights like shared preferences and buying patterns of customers to create segments. These in turn help predict the likelihood of purchase by customers who belong to the same segments. The next step would be to plan a personalized ad campaign to target them.

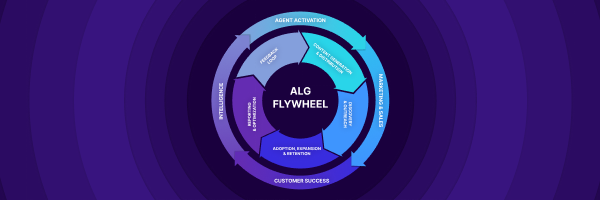

Use an automated MMM solution

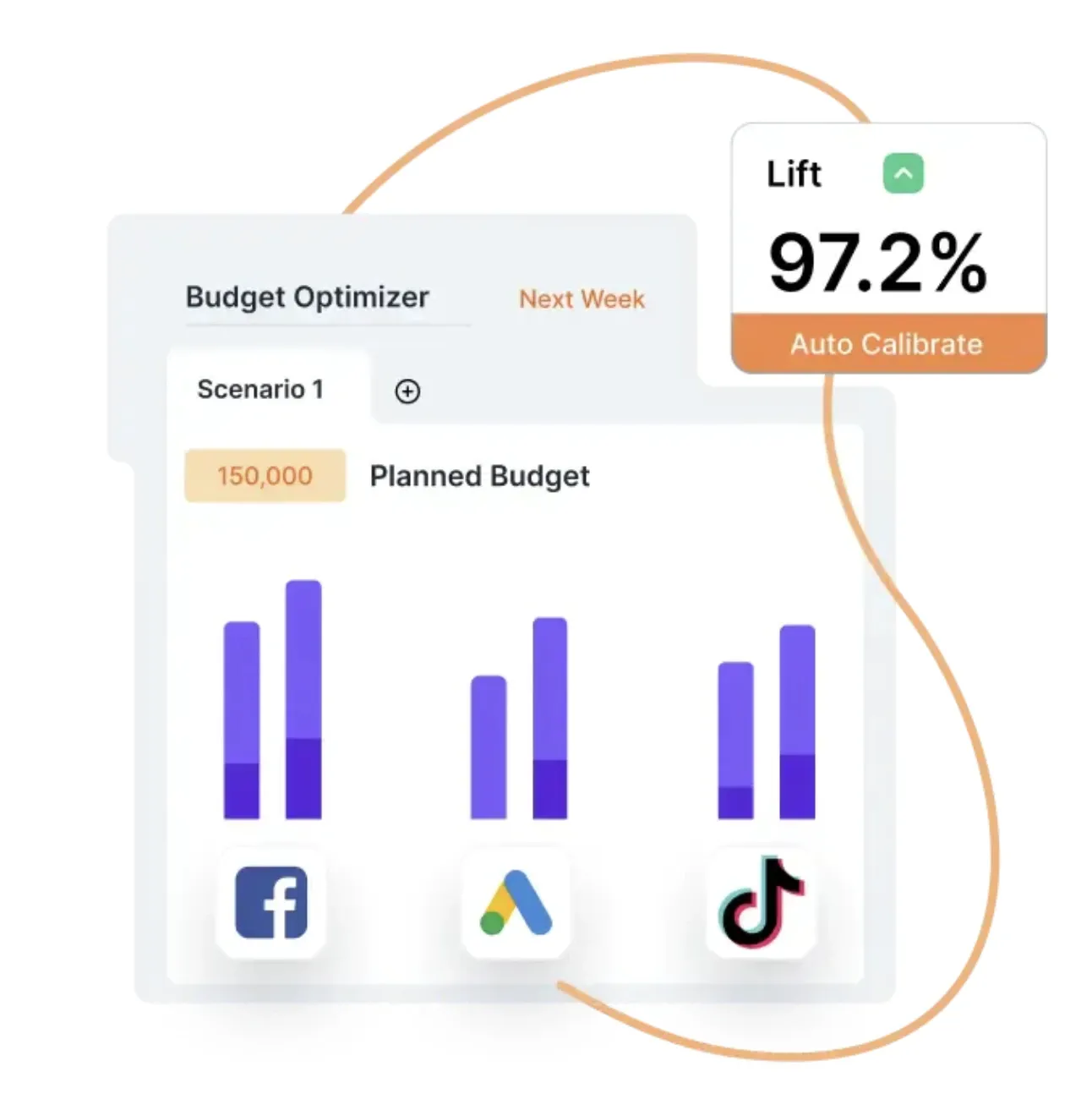

Analyzing seasonal performance manually is nothing short of a nightmare. You need an automated MMM platform like Lifesight to make data-driven decisions.

Unlike most marketing mix models that only model a static ROI, Lifesight tells you how effective your campaigns are during peak seasonal sale days compared to any other day.

That means it doesn’t just provide you with an average marketing impact for a particular period; it delves deeper into testing different budget scenarios based on the customer lifecycle.

Incremental Lift in MMM

Lifesight simplifies seasonality analysis by:

- Allocating budgets automatically based on historical data analysis

- Predicting trends based on historic patterns and suggesting when to increase ad budget and when to pause a campaign

- Using lift values from attribution and experiments for built-in calibration.

Let’s take an example here.

How to Measure Seasonal Marketing Mix Modeling in the Ecommerce Industry?

As we know, fluctuating conditions can make it challenging to predict the impact of your marketing budgets. That’s where marketing mix modeling (MMM) helps marketing teams measure the impact of marketing activity on sales.

More so in the Ecommerce industry, MMM is an essential tool to plan budgets and build out strategies.

So while the Ecommerce industry has unique seasonal challenges, here’s how marketers and CMOs can make the most out of their MMMs.

1) Consider the Shopping Seasons

Ecommerce brands face distinct seasonal shopping trends, such as back-to-school sales, Black Friday, and Cyber Monday. Understand these periods when forecasting sales. Start with historical sales data during these seasons to differentiate sales driven by natural demand from those driven by marketing efforts. Based on this, you can predict sales for different marketing budget scenarios.

Now, using this model you can forecast the number of conversions you should expect under different budget scenarios.

For example, if you know the sales are highest in November, you need to allocate the budget towards channels that contribute to the highest volume at that time of the year. When the sales decline, consider optimizing your mix towards ROI instead of volume.

2) Keeping up with the shifting economy

Economic conditions can directly influence consumer purchasing power and habits. An increase in online shopping might be linked to rising gas prices or changes in brick-and-mortar store accessibility. By incorporating macroeconomic factors, like inflation or unemployment rates, into your marketing mix models, you can anticipate shifts in consumer behavior.

3) Consumer priorities are on the move

Every ecommerce customer has a unique journey. Factors like age, location, and browsing habits can significantly influence purchasing decisions. For example, younger generations might be heavily influenced by social media ads, while older consumers may rely more on email marketing. Constantly updating your model with such insights ensures its relevance.

If you are an ecommerce brand, we recommend refreshing your models weekly or monthly and adding insights such as cost of living and savings to get a good idea of the price sensitivity throughout the customer journey.

4) Don’t hold back due to data scarcity

While a two-year lookback window is ideal, for newer ecommerce businesses, this might not be feasible. If your business faces unique challenges (like disruptions due to global events), consider extending the lookback window to capture a broader range of data.

That said, if you are a relatively new company without years of sales data, consider measuring techniques that require shorter resolution windows like attribution and incrementality testing until you have enough data to run your MMM.

Now is always the best time to learn and start building a data roadmap using roadmap templates for the future.

5) Use search and automated MMM solutions in your planning process

Every customer journey now starts with search and you need to design your MMM to measure its influence on seasonal trends. Include both organic and paid search activities in your model.

A best practice is to design your MMM to measure branded and generic paid searches separately. That’s because they play different roles in customer journeys. It is likely that generic search consumers come early in their path to purchase.

Another important thing: Use an AI-powered automated and continuous MMM solution like LifeSight to get a more holistic view of the impact of every channel and data source to build an accurate marketing mix model.

Get your essential checklist of data sources for MMM.

A pro tip: The insights gained from MMM depend on the freshness, relevance, and accuracy of the data you input.

Final Thoughts

Is there a way to not get misguided by seasonal marketing outcomes? Instead, analyze the root cause behind seasonal peaks.

What if we had an answer to these questions?

Lifesight’s automated marketing mix modeling allows you to measure the true performance of your marketing so that you can make data-backed budgeting and forecasting decisions backed by data.

Request a demo to know further.

You may also like

Essential resources for your success