About the brand

Rooted in the digital age, a major online marketplace platform is an innovation-driven retail brand, headquartered in a tech-centric locale of California. They combine AI-enabled analytics and savvy customer service to redefine what customer-centricity means today. With an ad spend of $1.2 Mn, they used Lifesight’s RFM Analysis tool to segment their customers into four groups: loyal, at-risk, new, and churned. This helped them identify their most loyal customers and those who were at risk of churning. Take a look at how our strategic alliance with Lifesight’s RFM Analysis tool catapulted our customer loyalty metrics by an astounding 40%.

The Challenge

Their marketplace was losing customers and struggling to keep them engaged. Their personalized campaigns weren’t working as effectively. They realized that they needed to understand their customer segments better to create more effective marketing strategies.

Primary Goals

- Enhanced customer experience and improved marketing ROI

- Customer Lifecycle Management through optimized customer journey

- Allocate marketing resources more efficiently by focusing on high-value segments and optimizing ad spend, channels, and messaging.

- Recovered revenue and revitalized customer relationships.

The importance of RFM Analysis

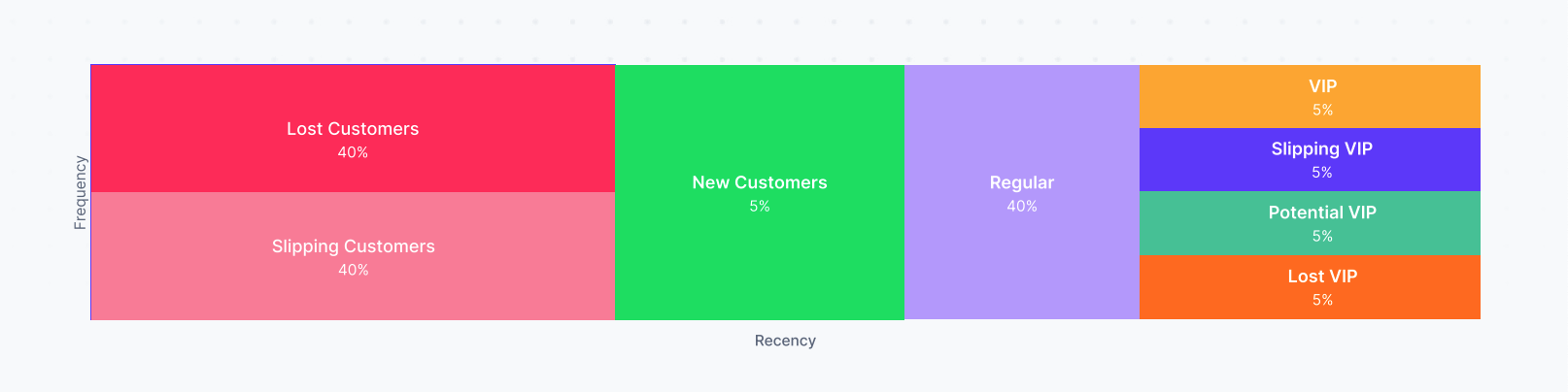

RFM (Recency, Frequency, Monetary) analysis is a model that segments a customer base into various loyalty levels based on the recency, frequency, and monetary value of their purchases. Applying RFM analysis, businesses can identify and target their most loyal customers with more personalized, effective marketing campaigns.

RFM analysis is a customer segmentation model that helps businesses identify and target their most loyal customers. It uses three key metrics to segment customers:

Businesses can use RFM analysis to create personalized marketing campaigns for each customer segment. For example, businesses can send special offers to their most loyal customers or offer them early access to new products. Here’s the methodical approach employed by the brand to leverage RFM analysis for refining its marketing initiatives:

The Solution

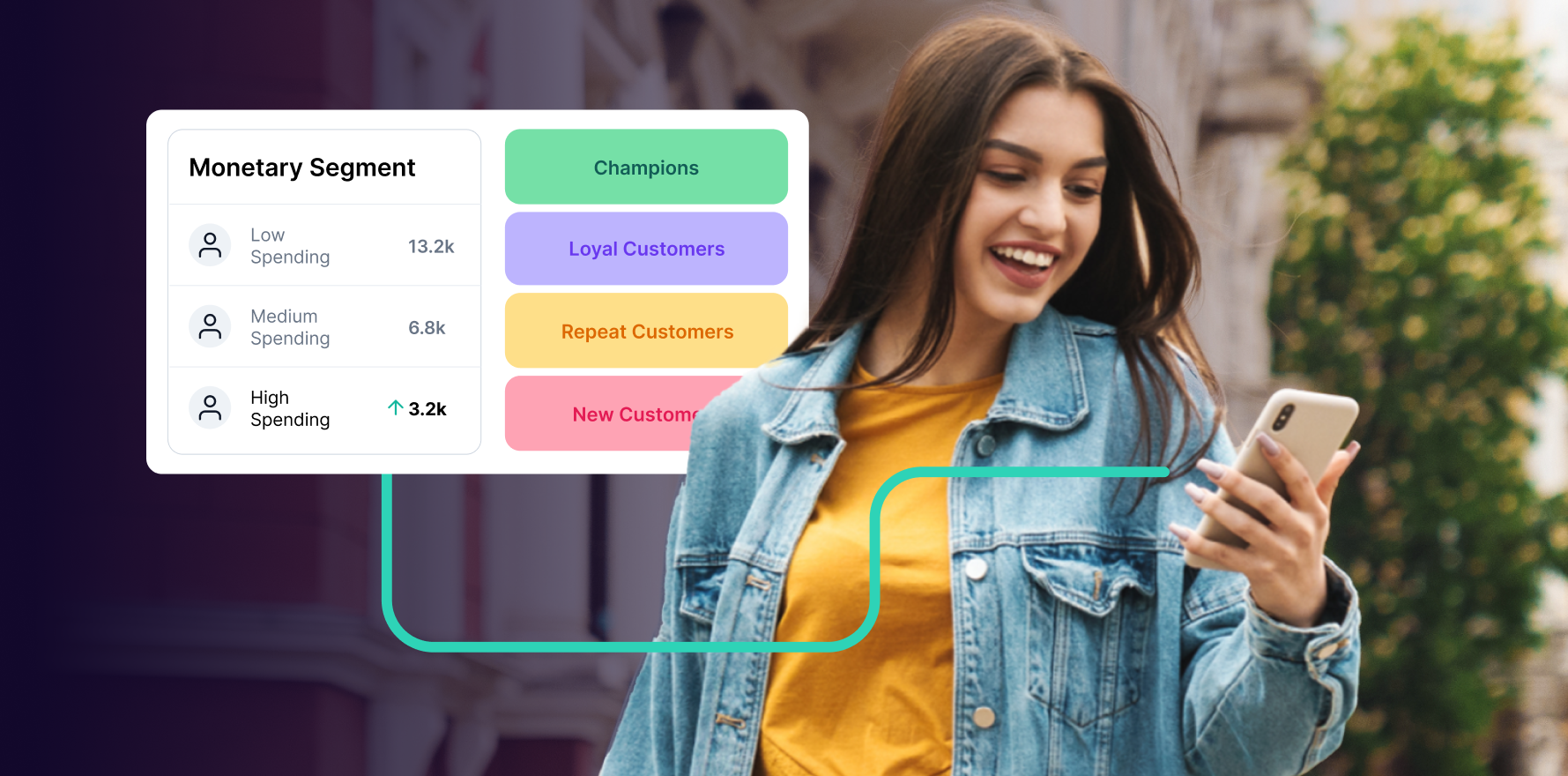

The brand turned to Lifesight’s Measure platform to gain insights into its customer base. Within the Measure dashboard under “Customers,” they could view their RFM Analysis report. This report broke down customer counts within various loyalty segments, such as

- Champions: Recent, frequent, and high-spending customer

- Potential Loyalists: Recent but less frequent or lower spending

- At Risk: Formerly frequent customers who haven’t purchased recently

- Can’t Lose Them: Customers who used to be regular and high-spending but have dropped off

Implementation Strategy & Methodology

- Loyal Customers: Individuals who have engaged in recent transactions, boast a history of multiple purchases, and have exhibited substantial monetary investment with the retailer.

- At-risk Customers: Customers who have recent engagements with the brand but lack a significant history of transactions or monetary investments.

- New Customers: Entrants who have initiated purchases recently but do not have a diverse transaction history or substantial financial contributions with the retailer.

Post-segmentation, the brand conceived personalized marketing strategies tailored to each customer group. For instance, loyal customers received exclusive offers like a 20% discount on subsequent purchases, whereas at-risk customers were enticed with gifts accompanying their future acquisitions.

This application of RFM analysis empowered the brand to orchestrate marketing campaigns with enhanced efficacy and resonance, ensuring precise and impactful customer outreach.

- Data Integration: The retailer giant integrated their customer data with Lifesight’s Measure.

- RFM Analysis: The brand ran the RFM analysis, identifying the various customer segments.

- Targeted Campaigns: Based on the insights from the RFM Analysis, the retailer developed targeted marketing campaigns for each segment.

- Performance Tracking: They closely monitored the engagement and conversion rates to measure the effectiveness of their new approach.

Key Results

- 32 increase in customer loyalty levels

- 27% increase in engagement rates

- 20% uplift in overall revenue

- 18% decrease in customer churn rates