11.5%

higher revenue

11.7%

lower ad spend

19.3%

uplift in forecasted iROAS

13.6%

incremental lift

11.5%

higher revenue

11.7%

lower ad spend

19.3%

uplift in forecasted iROAS

13.6%

incremental lift

The Challenges

1. Highly competitive industry and marketing landscape

Due to the nature of the industry, Seidensticker invested heavily in digital marketing to reach customers across regions and touchpoints. Their campaigns span both brand awareness and performance-driven initiatives. While this ensured visibility across the customer journey, it also introduced complexity in tracking and optimization, leading to fragmented measurement.

2. Fragmented measurement approach

Each channel reported in isolation, leaving Seidensticker without a unified view of performance. This siloed approach made it difficult to identify true incremental impact, creating uncertainty in how budgets should be allocated.

3. Inefficient budget allocation & forecasting

Without clarity on what was really working, spend decisions were often based on incomplete insights. This hindered the ability to forecast outcomes accurately, especially in a seasonal, fast-moving industry like fashion, making long-term planning risky.

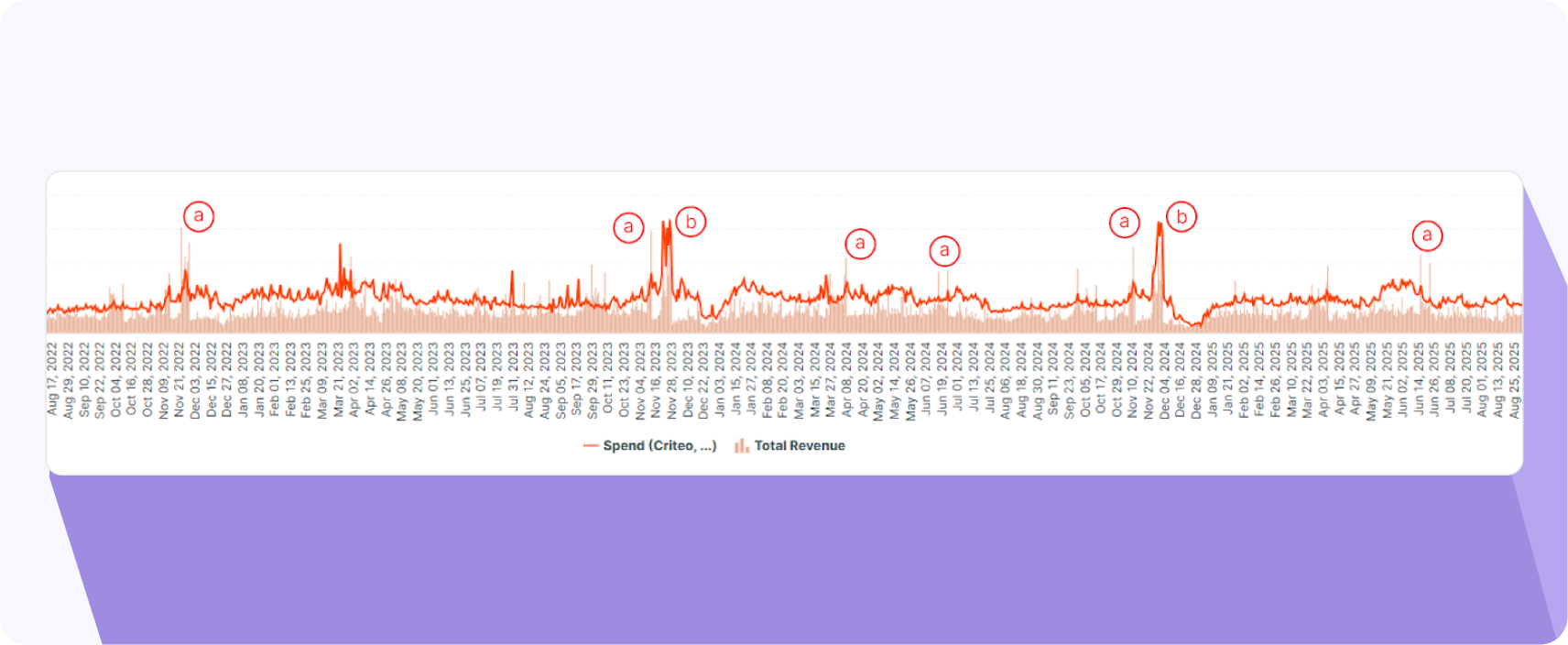

The insights above highlight that:

- Revenue often fluctuated unpredictably without corresponding changes in ad spend.

- Even with significantly higher spending during discounting seasons and holidays in 2023 and 2024, revenue gains were comparable to the prior year (2022) with smaller budgets. Raising questions about incrementality and wasted ad spend.

4. Scaling effectively while proving the value of upper-funnel spends

Their finance teams increasingly questioned the value of large upper-funnel investments in channels like Instagram and Criteo, where conversions are complex and drawn out. The marketing team believed these channels were vital for long-term brand health but struggled to prove their incremental revenue contribution.

The Solution

Seidensticker partnered with Lifesight to cut through the uncertainty by implementing a clear, unified measurement and planning process. Lifesight consolidated data from all channels into one single source of truth, replacing siloed reports with a transparent, unified view of performance.

By moving beyond platform-reported metrics, Lifesight’s MMM model helped Seidensticker uncover the true incremental value of each channel. This eliminated double-counting and highlighted where real revenue impact came from.

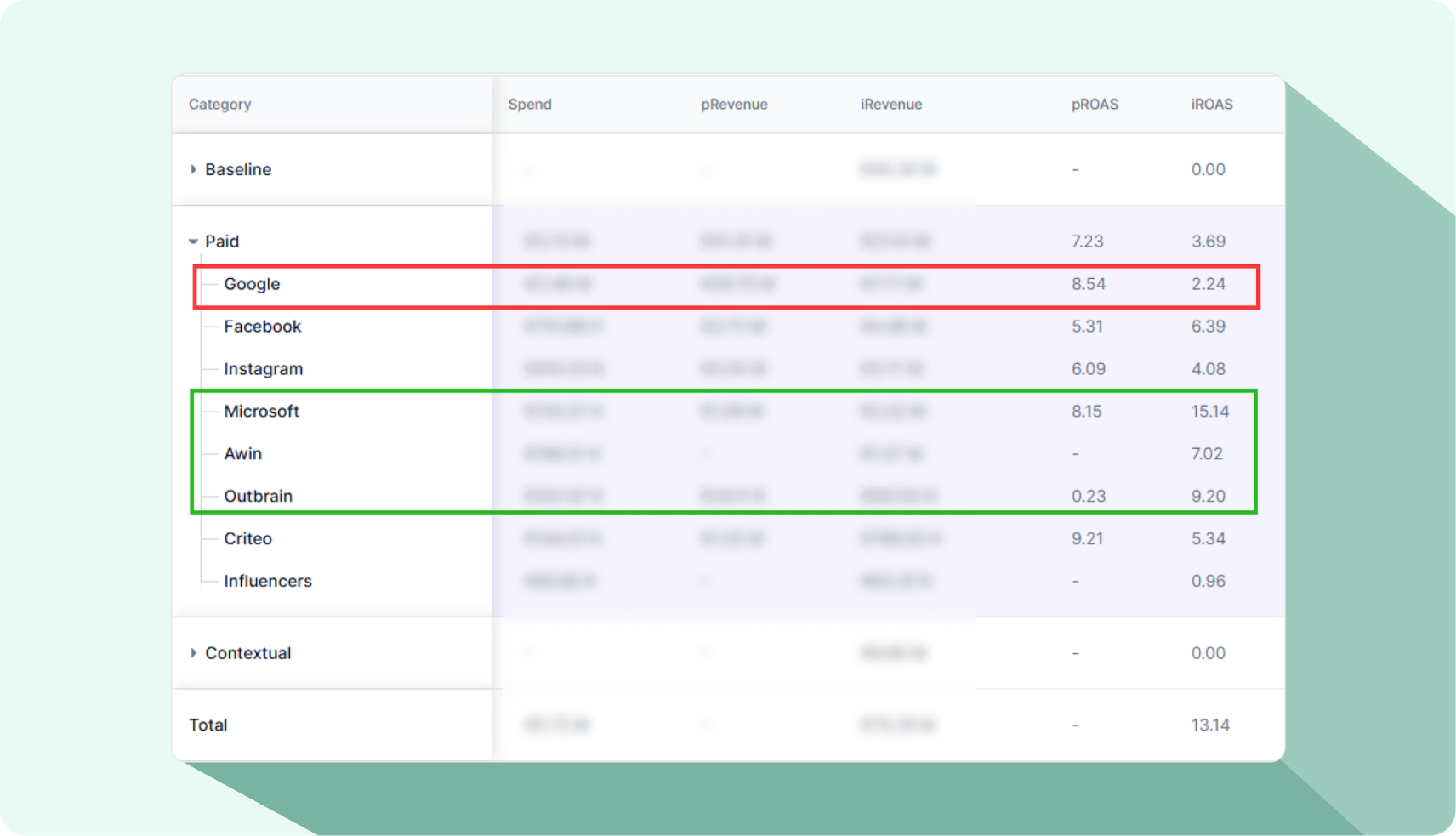

The model revealed stark differences between pROAS (platform-reported ROAS) and iROAS (incremental ROAS).

- Google’s reported ROAS of 8.54 has a major difference with the incremental ROAS of 2.24, showing overstated efficiency.

- Facebook & Instagram, on the other hand, demonstrated a stronger incremental ROAS (6.39 & 4.08) than might be expected, validating their upper-funnel role.

- Outbrain stood out with a very high incremental ROAS (9.20), making it a hidden growth driver.

This analysis gave Seidensticker the evidence to re-balance investments, cutting waste from over-credited platforms while defending budgets for channels with long-term value.

Forecasting and Planning for Growth

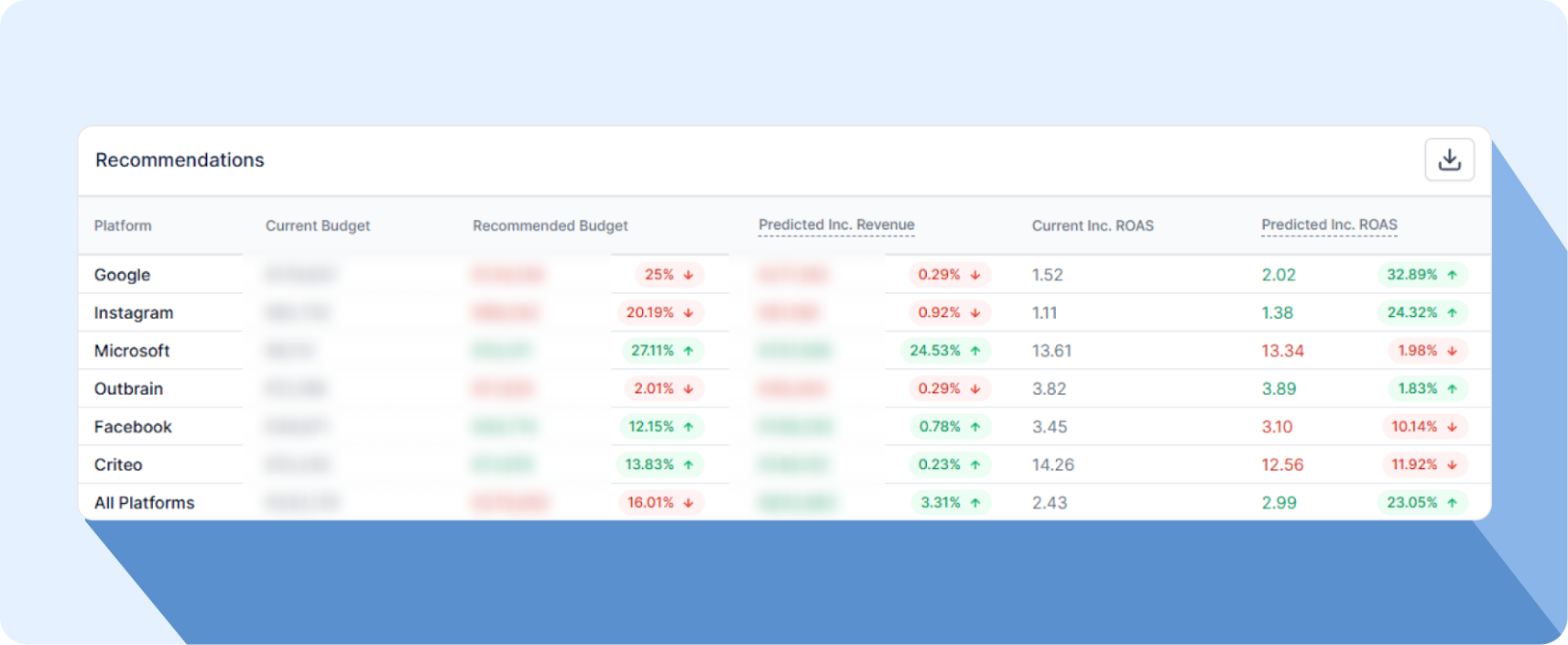

With incrementality insights and predictive modeling, Seidensticker could finally align spend with true performance drivers. Lifesight’s budget planner simulated different allocation scenarios, showing how revenue outcomes would shift based on investment levels.

The marketing team aimed to reduce spending while maintaining overall revenue. By simply reallocating funds toward higher-performing channels like Microsoft and Facebook, Seidensticker could achieve stronger media spend efficiency. Despite the reduced budget, but with the new media mix and budget strategy, Lifesight’s platform predicted an increase in overall revenue:

- A jump in incremental ROAS from 2.43 to 2.99.

- Microsoft’s reallocation is driving a 24.5% uplift in predicted incremental revenue.

- Even with reduced Instagram and Google budgets, total performance improved through a smarter channel mix.

This shifted Seidensticker’s planning approach from spending more to spending smarter, proving that efficiency and growth could go hand in hand.

Scaling growth while proving upper-funnel investments

Lifesight empowered Seidensticker to not just measure but also experiment and validate the true value of upper-funnel channels. This gave the marketing team concrete evidence to defend and scale investments that might otherwise have been challenged by finance.

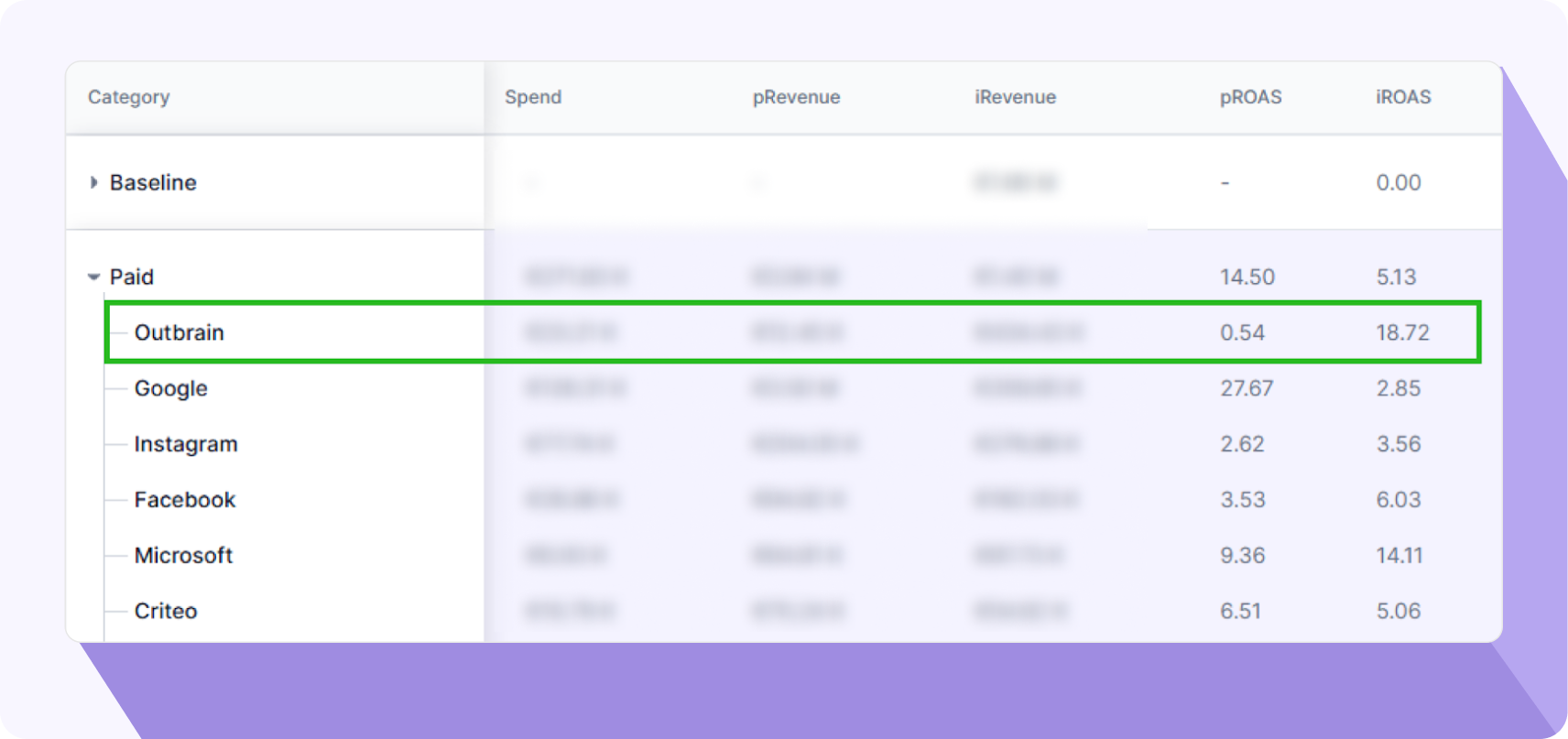

An experiment was run to test Outbrain’s high ROAS claims. Using a treatment vs. control market design, Lifesight uncovered:

- 13.6% experimental lift in orders with Outbrain campaigns.

- 98% statistical significance, proving the results were real and reliable.

- An adjusted iCPA of €16.07, significantly lower than the treatment iCPA of €28.30.

This rigorous testing approach gave Seidensticker the confidence to scale Outbrain spend, demonstrating that upper-funnel channels could deliver tangible incremental value.

The recalibrated MMM insights post geo experiment for July–August 2025 had already highlighted Outbrain as a quietly powerful driver, showing a strong incremental ROAS of 18.72 despite platform reports understating efficiency (pROAS 0.54). Resulting in smashing July 2025 goals by 11.5% with significantly lesser spend.

The Result

Conclusion

By ditching touch-based attribution, adopting unified measurement, proving incrementality, and validating upper-funnel value through experimentation, Seidensticker was able to transform the way it plans and invests in marketing. Lifesight not only helped the brand cut waste and improve efficiency but also provided the evidence needed to scale confidently across markets.

This case demonstrates that in today’s competitive fashion industry, the key to growth isn’t spending more – it’s spending smarter, with CFO-ready measurement you can trust.